Award-winning PDF software

Prthe following that would be reported on pkingfisher's 1125 E Form: What You Should Know

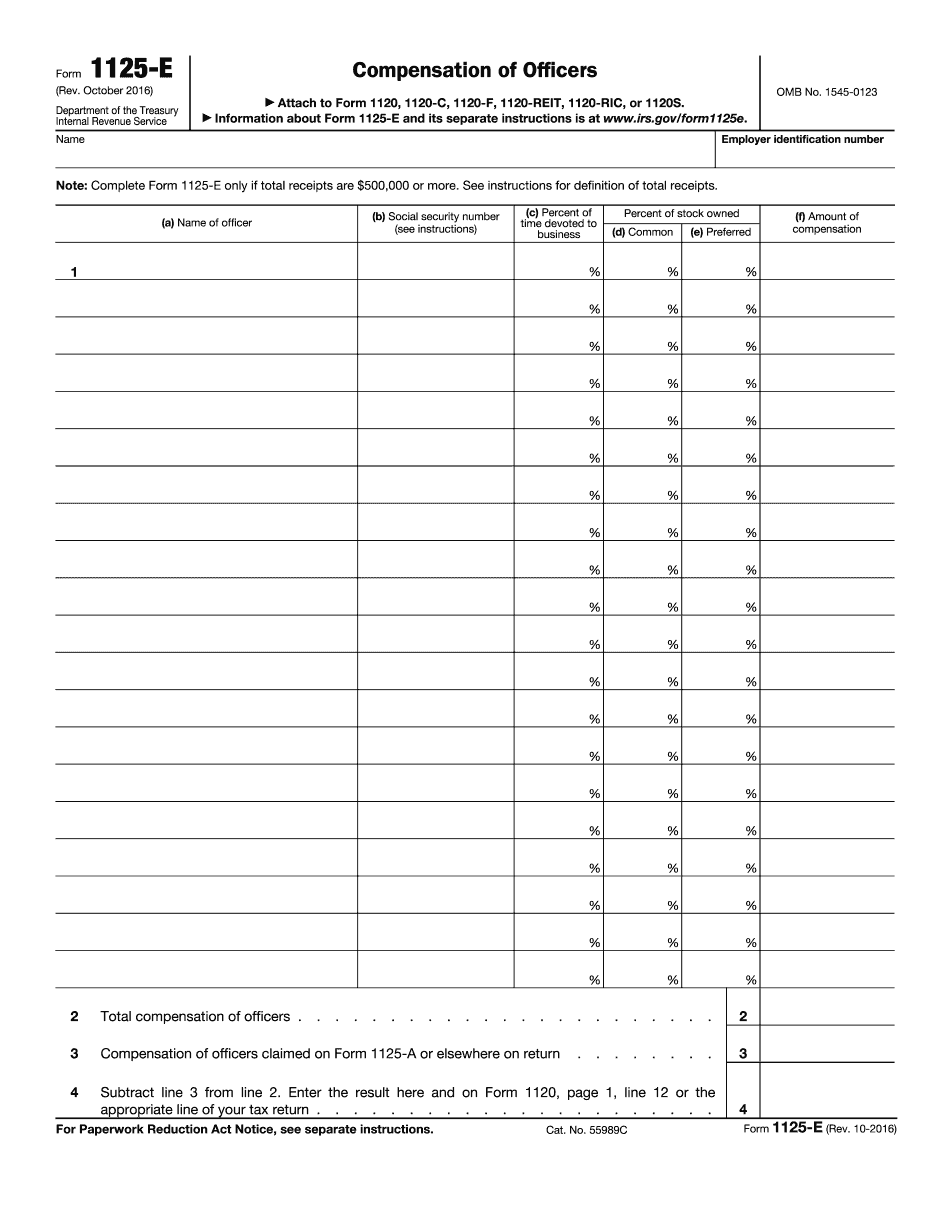

Instructions, officers must enter the value of all salary, bonus, stock, option or similar compensation received from or paid to them in a separate line of their Form 100 for Schedule A if the corporation does not have a total receipts limitation and the amounts paid to officers are paid from the annual revenue of the corporation. However, if the corporation has a total receipts limitation, the same values must be printed in each line of Schedule A, with the amount paid to the employee being on the line that does not have the limitation. Form 1125-E: Compensation of Officers and Other Employees. OMB No. 1379, IRS Form 1125-E 2016, IRS Form 1099-MISC (Rev. October 2018) Form 1125-E is a complete and accurate report for every officer and other employee (other than exempt executive officers), regardless of total receipts. A complete and accurate report must contain the following information (not shown here) The individual's principal place of business; The name and address of that business; The amount of compensation received by, or for the benefit of, such officer or employee; The dates of employment of the officer or employee. For more information on whether the Form 1125-E is an accurate and complete report, please click here (OPM No 1379). For more information regarding the IRS Form 1099-MISC, please click here (OPM No.1379). Form 1099-MISC, the Miscellaneous Form, describes income by category and type of payment. Other types of payment include income not reported by an employer or employee and amounts that have been determined to be not taxable. Information reported on an IRS Form 1099-MISC includes, among many other things, the individual's principal place of business, income and deductions. There are many other taxes other than income tax payable under the Internal Revenue Code that do not appear on a taxpayer's Form 1099-MISC, therefore if we are asked for the form we must provide them. What to include as income; how to figure income. Some income and deductions are reported as income in boxes 1 of the Form 1040. As a result, a taxpayer is limited by the “gross income” limitation on that tax return. All other income and deductions are reported as deductions on the “deduction-for” lines of the Form 1040.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1125-E, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1125-E online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1125-E by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1125-E from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.