Award-winning PDF software

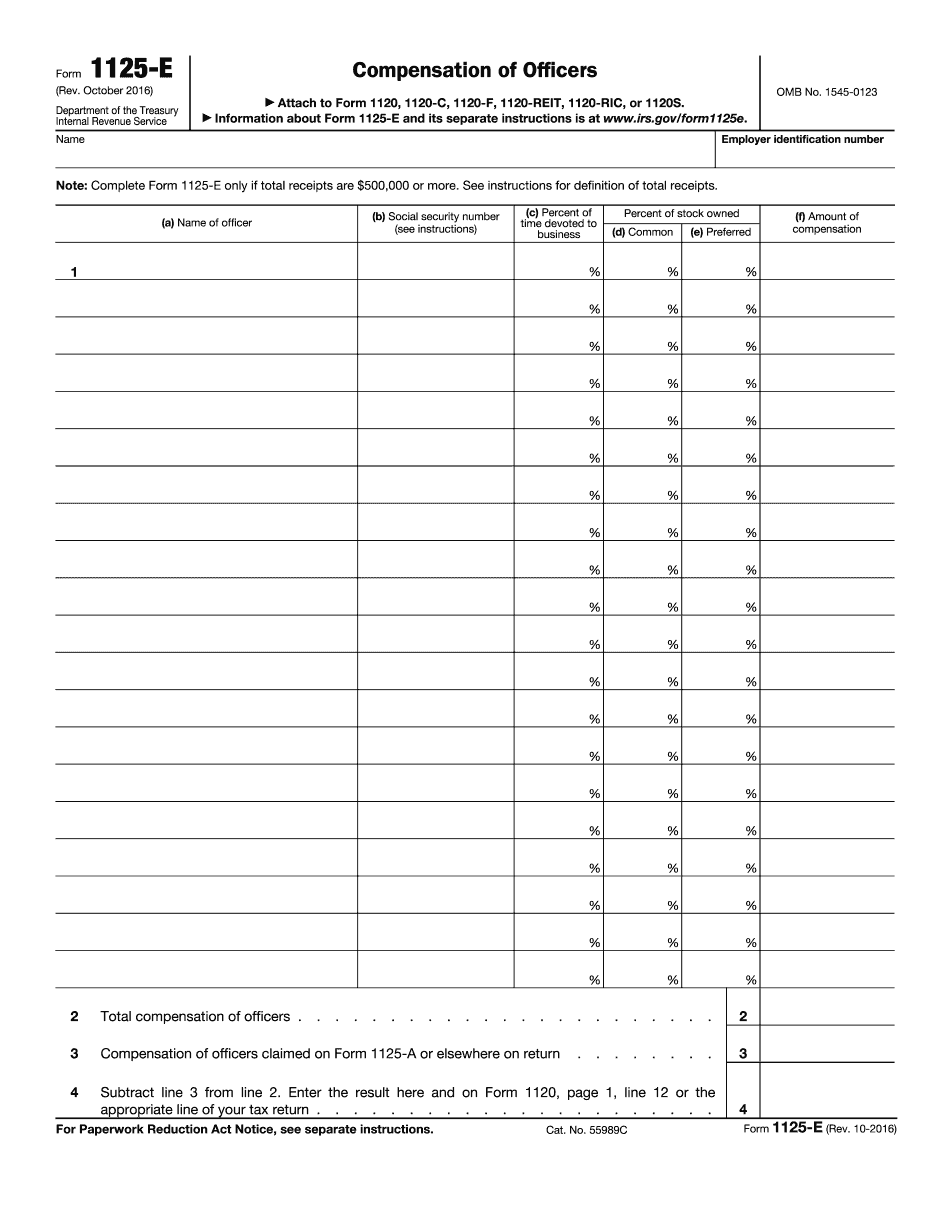

About form 1125-e, compensation of officers - internal revenue

For more information on filing the form, please contact the NAP or find a NAP office. For questions about how to obtain Forms 1125-E on paper, call or download the printable Form 1125-E from the NAP Website. What to include in your e-mail to the Form 1125-E. (i) In your e-mail, write the name of the agency, the name and title of the director of the agency and if applicable, a brief description of the action being reported on. (ii) In your e-mail, write the agency's address or phone number which may be used in a subsequent call to the agency. (iii) Include a summary of the information that is needed to determine the accuracy of the information reported on Form 1125-E. For example, the summary section of Form 1125-E should include any information requested by the Form 1125-E director to verify that the information being reported is correct, the date the action(s).

form 1125-e (rev. october 2016) - internal revenue service

Address . (d) Date of birth. (e) Type of company. (f) Name and address of partner (corporation, partnership, or association). (g) Company size and type. (h) Name of officer (if named as officer). (i) Date and time of receipt. (j) Amount . (k) Date of receipt. (l) Signature of officer. (m) Date of filing. Sealed Paperwork (PDF). Form 1125-Q (PDF). Form 1065 (PDF).

instructions for form 1125-e - reginfo.gov

Age. (d) Place of residence. (e) Employer name. (f) Employment period. (g) Employer identification number. (h) Social security number. (i) Employer identification number. (j) Employee's social security or SSS number. (k) Date of birth. (l) Sex. (m) State of birth. (n) County in which employed. (o) Social security number. (p) Number of employers or firms the employee worked for during the past year. (q) For each employer or firm, the number of employees and the number and type of employment contracts. (r) The number of employers or firms by tax year. (s) Total number of tax year hours worked, and the hours of each overtime work contract or overtime hours worked, the hours paid, and the salaries, wages, commission, and bonuses paid. (t) Number of overtime hours paid. (u) Total gross receipts during the tax year. (v) Total gross receipts since birth. (w) Total income since birth. (x) The.

form 1125-e "compensation of officers" - templateroller

Percent or more of its gross income from sources within the United States. For example, suppose a corporation has its gross income from sources within the United States of 100,000 and only 10 percent of its gross income comes from sources outside the United States. The 10 percent from sources outside the United States is reported on Form 1125-E using the regular tax code method if (a) a reportable dividend paid to the foreign stockholders is reported on Schedule D, which does not involve the taxpayer reporting his or her federal income tax in the manner prescribed by the IRC, (b) the corporation pays no withholding on the payments, and (c) no compensation of the foreign stockholders is treated as paid for services provided in the United States. Such reports are generally required with any payment made in such circumstances, such as the payment of a dividend to foreign.

Form 1125-e - compensation of officers - taxact

Or greater value of stock. You can also send Form 2555, Statement of Stock Ownership, to Form 1099-MISC. 1125-N, Nonemployee Director Compensation, is required for those persons who: (a) are not individuals, and (b) are not employed in the conduct of the company. The entity should use the Form 2551. 1125-O, Employee Stock Purchase Plan, is required for those individuals who: (a) are individuals, and (b) are currently serving as directors. In certain circumstances, this form must be completed under “The Employee's Compensation Plan” on a separate sheet of paper. 1125-P, Public Offer to Purchase Shareholders' Equity, is required in order to raise capital, as specified in Form 1099-MISC for all public offerings involving total value of stock held by the company of 5,000,000 or more. 1125-Q, Qualified Employee Stock Purchase Plan, is required by the plan if the employee is a specified nonfiling public company. If these individuals are nonfiling public companies, you must.