Award-winning PDF software

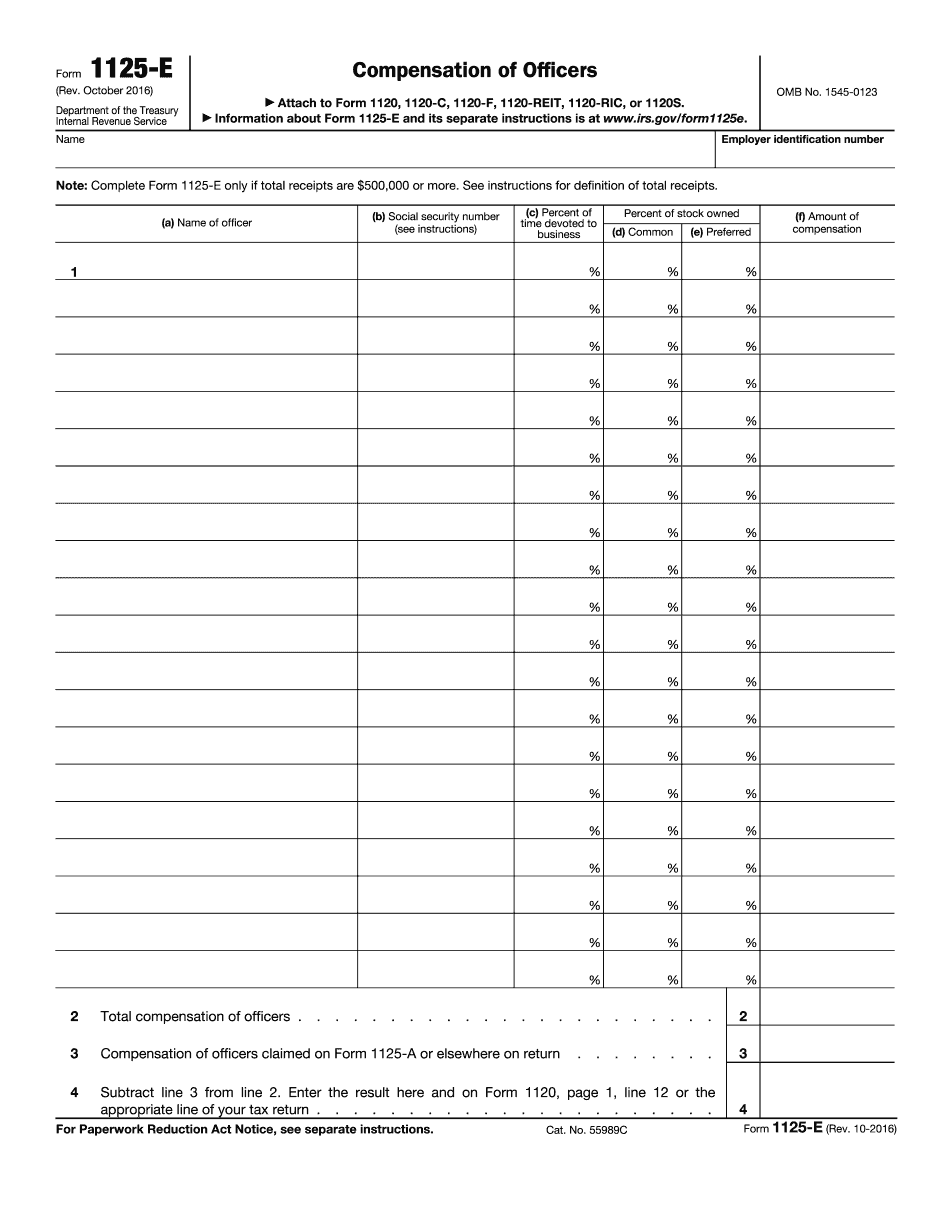

Aurora Colorado online Form 1125-E: What You Should Know

Date. 9/19/2018. 10:45 am. Telephone number:. Employee or Independent Contractor? Check here Forms/Directions on How to Form Your Own If you want to create your own form 1125-E for yourself, you also create a separate Schedule K-1 (Form 1065) for your business. Please go to our online form 1125-E form at the bottom of this page to create your own form. Tax Deductible Amounts for Employees and Independent Contractors. As a business, you have two options for what you charge the taxpayers: 1. Deductibles A deductible is an amount you charge that must be paid before the tax is remitted. Deductibles may be small, such as 5,000 for health insurance, or big, such as 30,000 for an automobile or home. However, just as in personal income there are no exceptions to the rule that a deduction for your business can't exceed 25% of your net profit. 2. Non-Deductible Employer Payments (Payments for Employees & Independent Contractors) Payments for employees or independent contractors are taxable as wages when received. These include paychecks, gratuities, commissions, bonuses, commission and stock options (including stock options granted after the close of an employee's employment). There is a difference between deductible and non-deductible payments. The law says this: Employee payments are a deduction from your earnings, and are subject to section 530-521 of the IRS regulations. These payments include salaries, allowances, commission payments paid after your employment has terminated, payments to make up for past payments that were withheld from your paycheck, payments to purchase a trade or business, compensation for work done outside the United States, and payments for services performed under a written employment or commission agreement. In contrast, independent contractor payments are nondeductible. They are part of the value of a good or service you provide that is taxable as wages. Examples of nondeductible independent contractor payments include the following: Payments for services performed to meet an existing or projected need (e.g.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 1125-E, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 1125-E?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 1125-E aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 1125-E from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.