Award-winning PDF software

Form 1125-E Chandler Arizona: What You Should Know

Treatment of Certain Compensation — Revenue Ruling 2014-24 On May 11, 2014, the IRS issued Revenue Ruling 2014-24, which provided detailed guidance concerning the application of an entity's compensation committee rule in cases where an entity's compensation committee decides whether to accept an outside offer to sell an asset. Revenue Ruling 2014-24 — IRS The Revenue Ruling 2014-24 provides the IRS with the necessary information to implement the change from the old rule stating the compensation committee need not make a determination about a sale before the entity has been notified and provided an opportunity to object. It also provides guidance on the circumstances in which the IRS will not apply the committee rules. Notice 2016-15, IRS Notice 2016-15 — IRS Notice 2016-15 is a notice from the IRS that the IRS is issuing a Revenue Procedure to implement the Notice 2016-15, as set forth in Sec. 1012. This revenue procedure will allow an IRS tax return preparer to request an adjustment to amend Form 1099-MISC, Miscellaneous Report of Income, for a Form(s) W-2 with respect to all types of compensation paid (i.e., salary, bonuses, commissions, and equity). Form 1099-MISC with Adjustments or Adjusters — Notice 2016-15 The Form 8606 Instructions in Internal Revenue Bulletin 2014-24, will provide the IRS with information for completing, or amending, a Form W-2 to include the compensation from Form 1116, Supplemental Profit-Sharing Income. Additional Resources — TI GTA The IRS issued a TI GTA audit report. Additional information can be found at TI GTA's website. For more questions about Form 1125, contact TI GTA, via: TI GTA:; To report suspicious activity, you can file an Electronic Reporting Information Notice (ERIN) with TI GTA, by using IRS.gov/ERIN or by phone (). For more about electronic filing, visit IRS.gov/EIFT or use the phone number. This is an opinion piece.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E Chandler Arizona, keep away from glitches and furnish it inside a timely method:

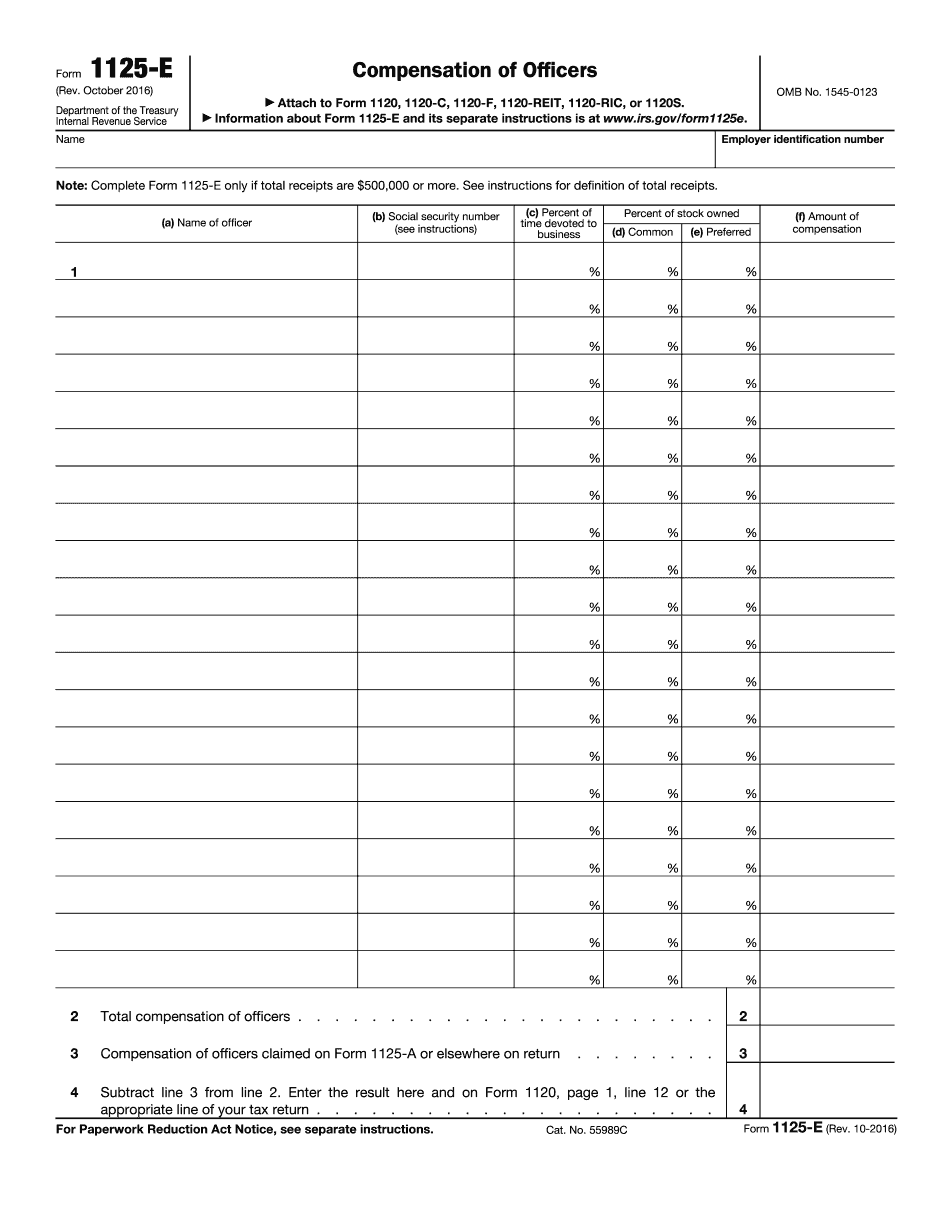

How to complete a Form 1125-E Chandler Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E Chandler Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E Chandler Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.