Award-winning PDF software

Form 1125-E for Raleigh North Carolina: What You Should Know

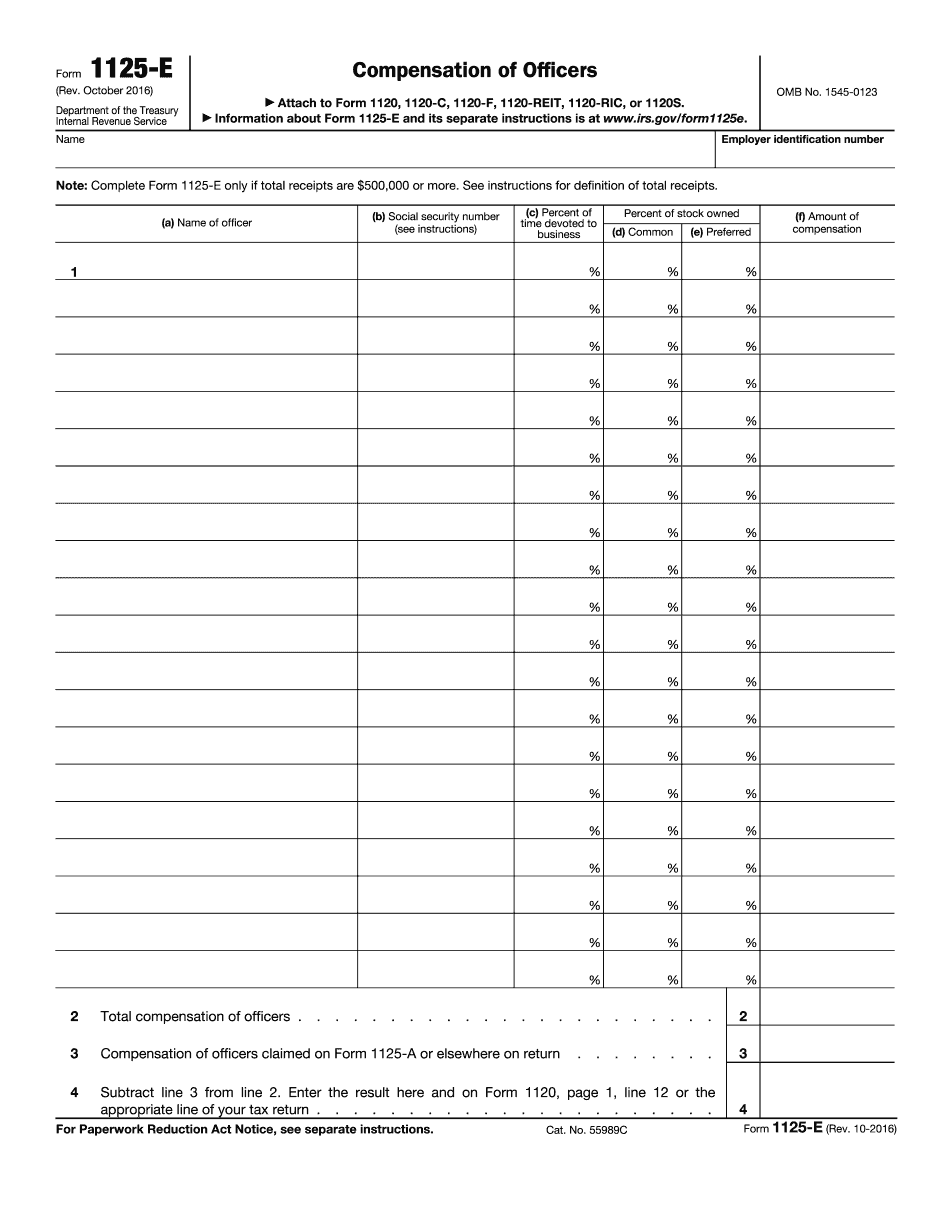

The Form 1125-E allows us to prepare for an upcoming Actors' Tax Convention. Instructions for Form 1125-E — R. Scott Grady, CPA, LLC Complete Forms 1125-E ONLY if total receipts are 500,000 or more. See instructions for definition of total receipts. (a) Name of officer. (b) Date the gross receipts were realized. Social security tax amount. (d) Estimated tax due. (e) Expected tax payment date. The Form 1125-E is an IRS document used to prepare income tax returns and/or to claim an exclusion in the case of an actor in a movie. The Form 1125-E contains additional information to prepare for the Convention, a schedule of events to be covered, a schedule of allowable expenses and additional information regarding the actor's share of the net receipts from the Convention. Downloadable Registration Form — R. Scott Grady, CPA, LLC Complete the Registration Application Form (PDF) to report Actors' Convention expenses. Instructions for Registration Form — R. Scott Grady, CPA, LLC The Registration Form, with a few additions, is required when you intend to spend more than 250 per day for food and lodging during the Actors' Convention. For further information, see the FAQs below on lodging expenses. FAQs: Lodging Expenses (PDF) You must make out the Form 1040X if you are receiving compensation for the cost of lodging during a Convention that is held in North Carolina for the benefit of an actor not performing in a movie. Example: Joe is not receiving compensation for hotel accommodations but has to stay at the hotel to protect himself from the actor in the movie who he is trying to convince leaving town. What If a Schedule of Events Does Not Appear? A Schedule of Events will not appear if your total receipts on Form 1125-E for the Convention do not exceed 500,000 for the year or 200,000 if it is fewer than 12 months in the calendar year. If you are receiving compensation for lodging during the Convention, but you do not want a separate Schedule of Events or, if none are required, if your receipts do not exceed 500,000 for the year or 200,000 if it is fewer than 12 months in the calendar year, you can use this form. If a Schedule of Events does not appear, include as much information as possible.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E for Raleigh North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1125-E for Raleigh North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E for Raleigh North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E for Raleigh North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.