Award-winning PDF software

Form 1125-E online San Antonio Texas: What You Should Know

The Form 3930 forms an annual report. If you need information about Forms 3930 and 3931, the tax office has the following publications: Tax-Exempt Organizations of Private Non-Profits — Marcus LLP Form 3931: Annual Return of Ownership of Privately Held Securities — Marcus LLP The following resources are available on Marcus LLP's website for this information: The Tax Operator has similar information, but is much more comprehensive: Internal Revenue Service Form 3921: Information Return to Shareholders of Tax-Exempt Organizations of Private, Nontaxable, and Sole Proprietorship — Marcus LLP These documents will provide general information about Form 3921, so you can understand how to fill out the form and why and when you may need to report information that falls within its scope. However, you will need to understand how to fill out a form that is intended to comply with the regulations pertaining to a particular non-exempt organization, so you can understand what information you can or cannot include in any return. You also will need to understand that your answer in response to any questions is only an opinion as to the facts and circumstances. Internal Revenue Service Form 1040, Instructions for Individual Returns — Marcus LLP Form 1040 is a tax return that generally includes instructions for filling out the form and providing the required information. The Instructions for Form 1040 provide general instructions for the completion and filing of Form 1040. Form 1040-A, Instructions for Forms 1, 10, and 40 — Marcus LLP Internal Revenue Service Form 1040-EZ, Statement of Cash Payments and Other Income by Taxpayers with Respect to Certain Foreign Corporations and Certain United States Corporations — Marcus LLP Forms 1040 and 1040-EZ are generally intended for businesses engaged in activities that receive income through U.S. sources. When completing those forms, it is useful to know that most of that income, and some of that income that comes from source in U.S. sources, is subject to income tax. For this reason, tax advice may be beneficial to check with a corporate tax attorney before completing these forms. Form 1040-NR, Information Report—Social Security and Medicare Taxes Paid by Individuals With Respect to Certain Foreign Corporations and Certain United States Corporations — Marcus LLP Form 1040NR is essentially a social security number (SSN) report. It includes information about an individual.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E online San Antonio Texas, keep away from glitches and furnish it inside a timely method:

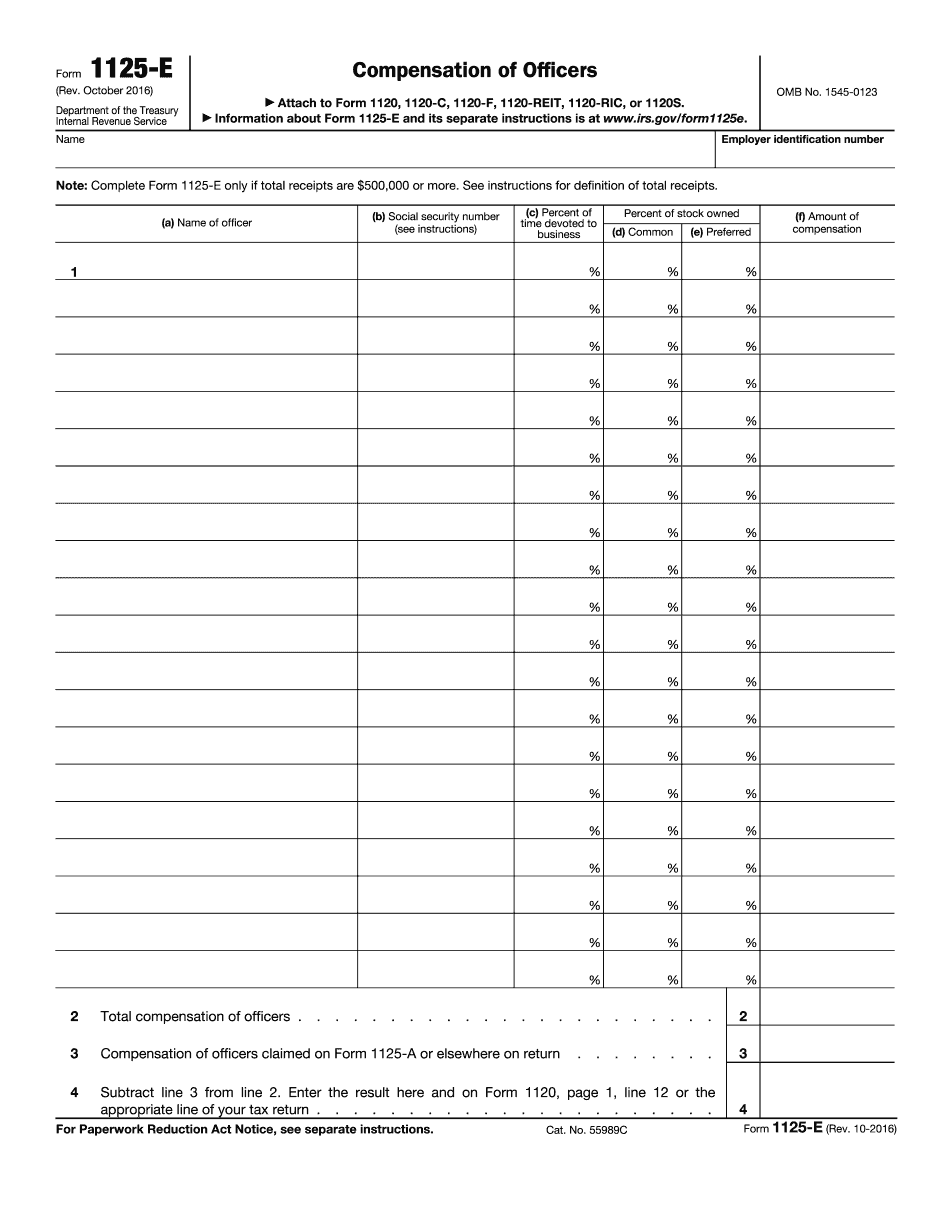

How to complete a Form 1125-E online San Antonio Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E online San Antonio Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E online San Antonio Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.