Award-winning PDF software

Middlesex Massachusetts online Form 1125-E: What You Should Know

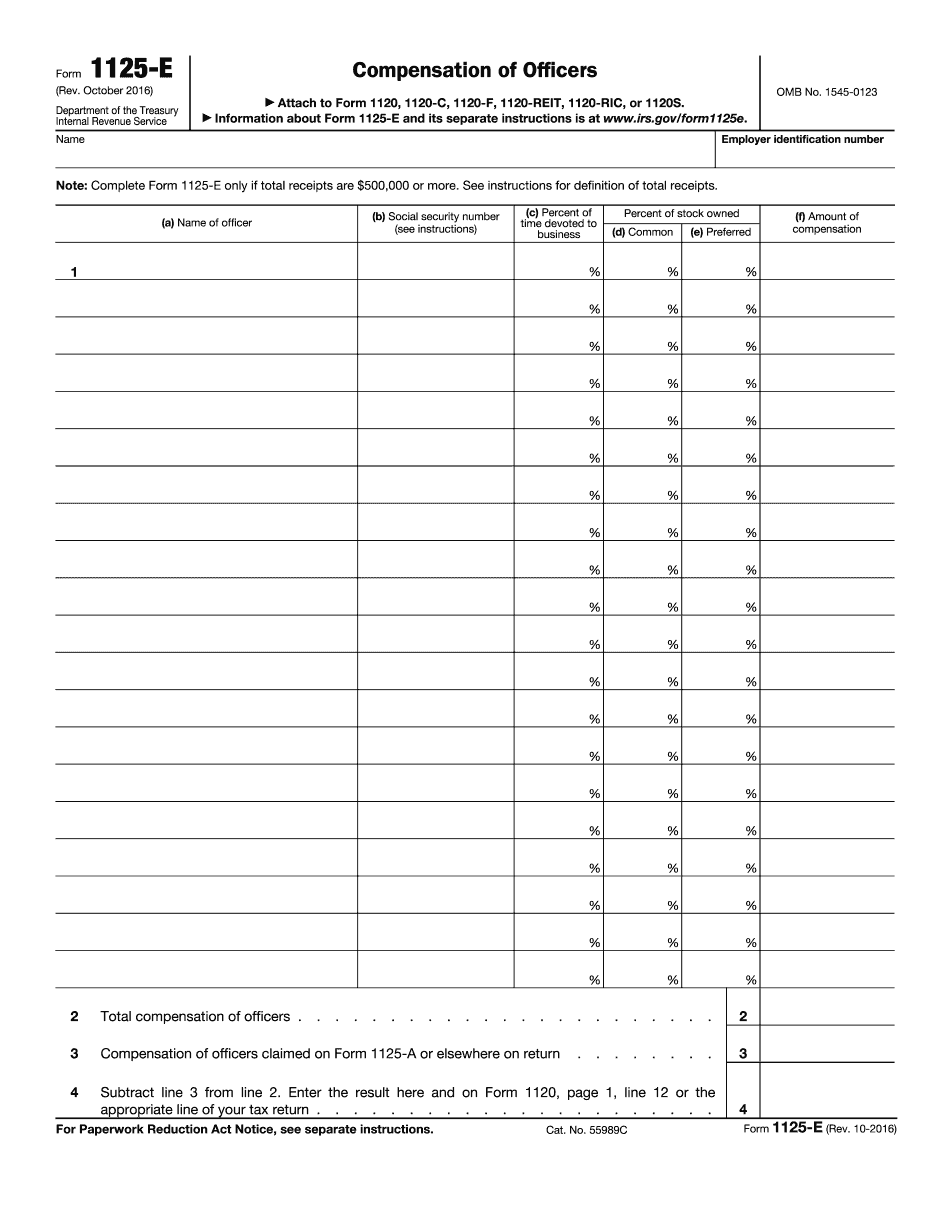

New Hampshire Residents New Hampshire residents should fill out Form 1125-I and submit as PDF to the State Department of Taxation/Bureau of Tax Services. The cost to you is 50.00 in New Hampshire. Form 1125-I (Rev. October 2017) Massachusetts Resident — Massachusetts taxpayers must fill out and attach to Forms 1125-I, 1125-K and 1115-I. New Hampshire residents cannot use form 1125-I because New Hampshire income tax liability is computed on the individual income tax return. Form 1123, Report of Education by a Deaf or Hard of Hearing person for a Person with a Disability, a Student with Disabilities or a Child with a Disability for Individuals with Postsecondary Education and Training If more than one person has disability, the report is a separate individual return. To be filed. Massachusetts residents may submit form 1123 at least once every year, except for students whose tax return is due every two years. Forms, including Schedule H (Form 5400). If you are enrolled in higher education, and you have a disability, or you are a student with a disability, you may have a disability and need to complete a Schedule H to determine which of the two options, a direct PLUS loan or an income-related repayment plan, (IRR) is the best fit for you for the repayment period. This type of disability and program requirements are described on the appropriate government websites. Other Forms — see Instructions for Forms. Other supporting documents needed for a tax deduction include: Social Security Number. This will be automatically entered on line 2c of form 1125-E. Income tax withholding form. This will be automatically entered on line 2a of form 1125-E. Please see Form W-4 for instructions. 1. The total of line 9. Note: If any of the statements under the “Payment Amount” line are more than 500, you must submit a statement with your form 1125-E showing the amount of all payments over the 500 shown under line 9. Example of a statement included under line 9 in order to make the deduction for a single tax year, where an income tax return is due every two years: “Tax paid after 1/31/15 with 2,600 on hand” Note that this 2,600 is an accounting entry, since each 500 of income is counted as a payment.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Middlesex Massachusetts online Form 1125-E, keep away from glitches and furnish it inside a timely method:

How to complete a Middlesex Massachusetts online Form 1125-E?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Middlesex Massachusetts online Form 1125-E aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Middlesex Massachusetts online Form 1125-E from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.