Award-winning PDF software

Form 1125-E AR: What You Should Know

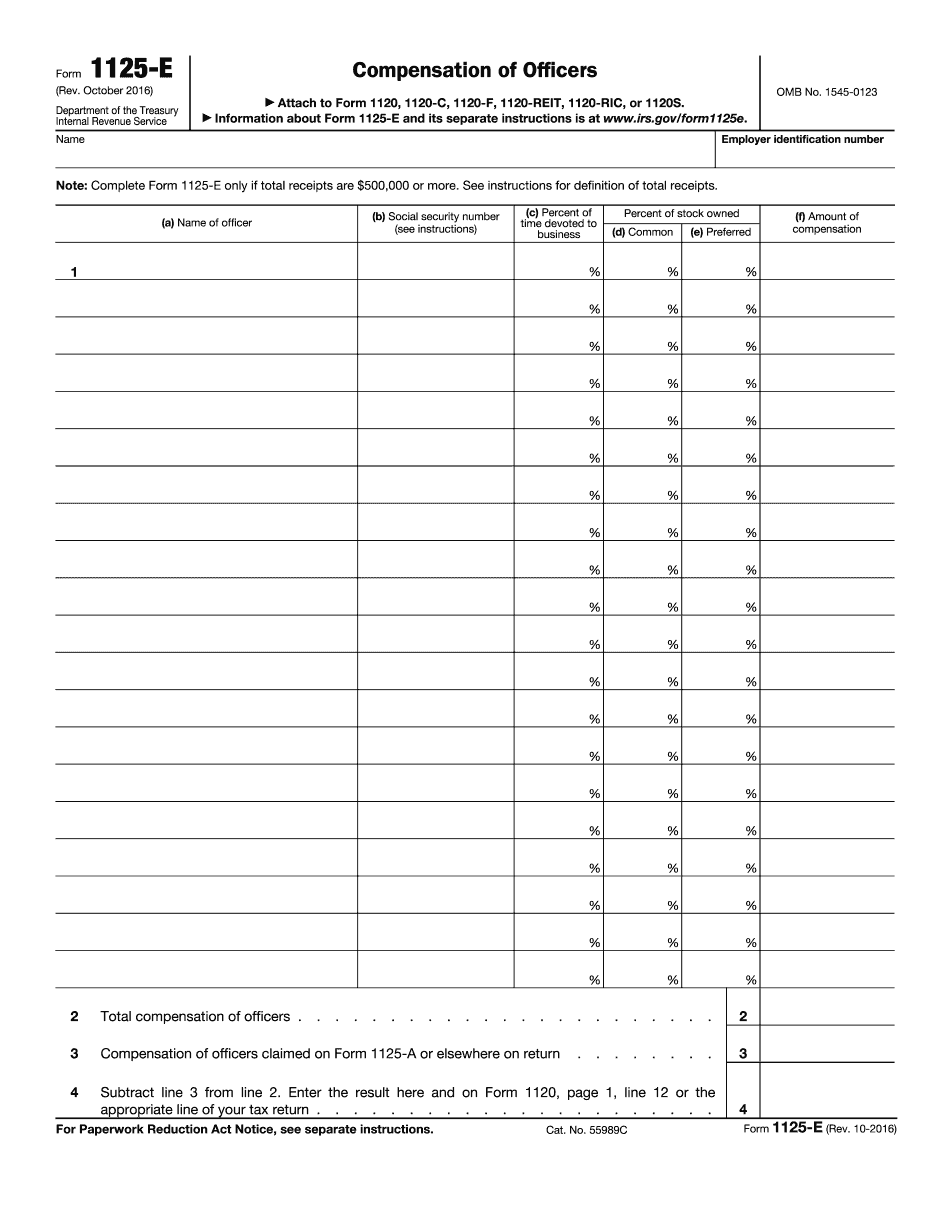

For more information, see Federal Form 1220 (Compensation of officers). Employment Income Tax Returns For 2018 The Internal Revenue Service issues Electronic Federal Tax Return Employer (EFT) for individuals, employers, and self-employed persons. It can be downloaded here. Note: Form 1040 EFT must be completed on paper for IRS to issue a paper tax return. A completed EFT is available with Form 1040, 1040A, 1040EZ and 1040NR. Federal Form 1040EFT, Electronic Federal Tax Return Employer For IRS tax filings for 2025 and beyond, I recommend TaxA ct's TurboT ax for individuals (both corporations and businesses), businesses, and self-employed individuals. I encourage everyone to check TaxA ct before filing. I have not seen a paper-based version of TaxA ct for IRS, so you must use their software to prepare your return. TaxA ct is simple and easy to use, with the free version. You can print a tax plan for free. TaxA ct and TurboT ax have added a paper-free version of IRS.gov for the TurboT ax 1040 ETA, which will save you the time and aggravation of writing IRS forms. You can download these free versions of IRS.gov from TaxA ct's TurboT ax Business website. I had been a user of the Paper Free IRS software since the 2025 versions but felt it became necessary to try out the new TurboT ax 1040. Both software will allow you to take advantage of their free versions of IRS.gov. TurboT ax Tax Preparation Software Note: The TurboT ax Free and 24.95 TurboT ax Individual Version both work for people who file their taxes online and have been approved for the Tax Act Free Edition or have been enrolled in the TurboT ax Student Edition. IRS.gov allows you to fill out IRS Form 1040-ES and IRS Form 1040-F. There are two free, TurboT ax versions for IRS.gov that can give a tax preparation benefit to taxpayers with limited computer skills. If you need help in the preparation of your taxes to file electronically, TurboT ax is the easiest and most complete tax preparation software available. When you sign up for our email list to receive important information as it becomes available, we will send you a coupon for a free account upgrade. The free upgrade will give you better search options, the ability to save your tasks, and more.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1125-E AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.