Award-winning PDF software

New Mexico Form 1125-E: What You Should Know

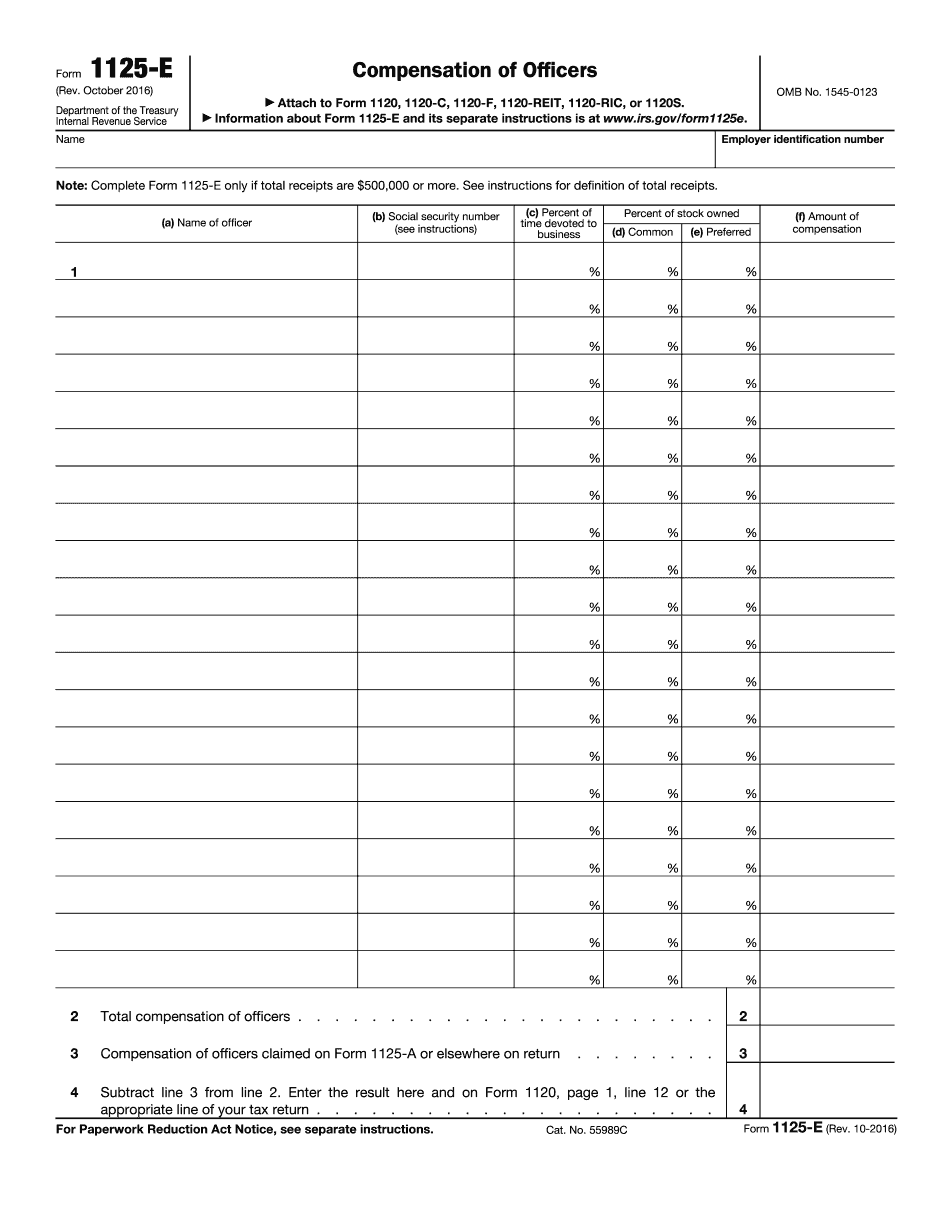

If the 2025 IRS guidance changes apply to this form, we have updated the current version of form 1125-E accordingly. Form 1125-E was first created in 1970 to implement the federal “Salary Adjustment Incentive Plan” or SA AIP, which provided a 3% increase in total compensation for the members of the executive and professional staff to be paid to non-federal executives and professionals in tax years and to federal professionals in tax years 2018-19. The SA AIP was terminated by Executive Order 12438 (Oct. 13, 1970). See here for more details. Employees of the state and local government are paid as if they were federal employees, or their equivalent, and are eligible to participate in the SA AIP. See also here. In addition, SA AIP participants are entitled to certain other employee benefits not provided by the federal government. Form 1125-E was also established under a federal law to allow the state and local governments of New Mexico to adjust executive compensation for state and local employees while maintaining the federal standard of equal pay. Federal Employees Benefit and Compensation Act (FEB CA), 26 U.S.C. 4975. The FEB CA allows a “statute of limitations” to begin if a law agency files an initial request for a review and determination under the FEB CA within 120 days after the request to a court or governmental agency. The state and local governments in New Mexico are entitled to compensation in accordance with FEB CA if their employees are eligible to participate in the SA AIP. This is the earliest date by statute where compensation can be adjusted for executive employees. The SA AIP is no longer in existence but has survived in New Mexico, in part because only state and local government employees are eligible for it. In May 2017, Governor Martinez signed into law a new law establishing one of the “three R's” under the state pay plan. (These are Real Retirement, Real Retirement Plus, and Reinvestment in Public Education) See here for more details. New Mexico is one of the 31 states in which the IRS “voluntarily” collects information from taxpayers. See Form 9002, Federal Tax Year 2025 Federal Individual Income Tax Return, (IRS) for the state tax year 2015.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete New Mexico Form 1125-E, keep away from glitches and furnish it inside a timely method:

How to complete a New Mexico Form 1125-E?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your New Mexico Form 1125-E aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your New Mexico Form 1125-E from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.