Award-winning PDF software

How to prepare Form 1125-E

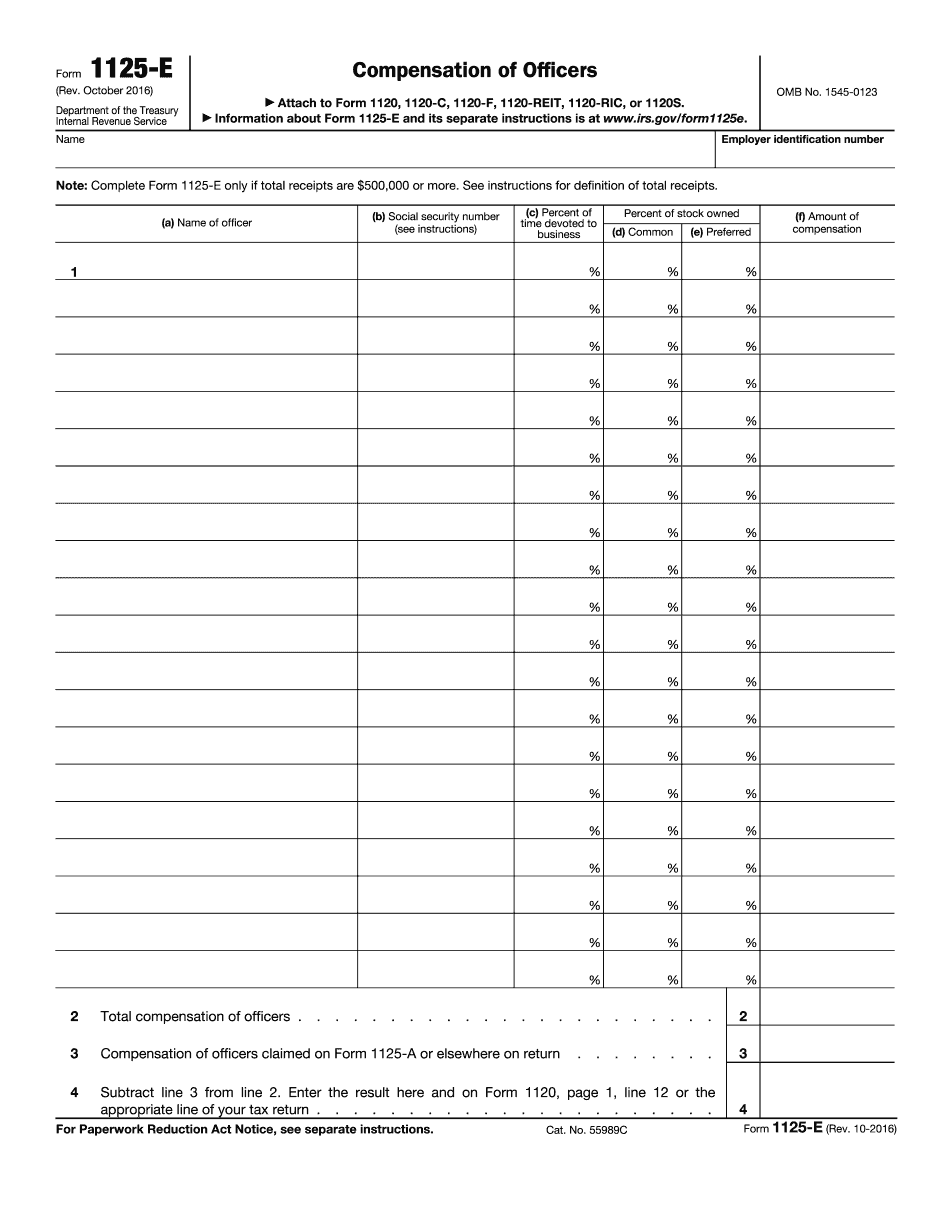

About Form 1125-E

Form 1125-E is an IRS tax form used to report businesses expenses for advertising and promotion, amortization of intangible property, and other deductions related to their business activities. It is specifically used by corporations whose gross receipts or sales exceed $25 million or corporations with deductions over $1 million for compensation paid to officers, shareholders, and employees. This form is a critical financial statement that helps the IRS determine the proper amount of taxes owed by the corporation. It provides an accurate and detailed representation of the businesss deductions, allowing the IRS to identify potential inaccuracies or fraudulent claims. Any corporations that meet the previously mentioned revenue and deduction thresholds are required to file Form 1125-E along with their tax return.

What Is 1125 E?

Online solutions make it easier to arrange your file administration and improve the productiveness of the workflow. Follow the quick manual as a way to complete Irs 1125 E, keep away from errors and furnish it in a timely way:

How to fill out a 1125e?

-

On the website containing the form, choose Start Now and go towards the editor.

-

Use the clues to complete the applicable fields.

-

Include your personal information and contact details.

-

Make absolutely sure you enter accurate details and numbers in proper fields.

-

Carefully revise the information in the blank as well as grammar and spelling.

-

Refer to Help section if you have any questions or address our Support staff.

-

Put an electronic signature on the 1125 E printable with the support of Sign Tool.

-

Once blank is done, click Done.

-

Distribute the prepared form through electronic mail or fax, print it out or download on your device.

PDF editor lets you to make modifications in your 1125 E Fill Online from any internet connected gadget, personalize it based on your needs, sign it electronically and distribute in different approaches.