Award-winning PDF software

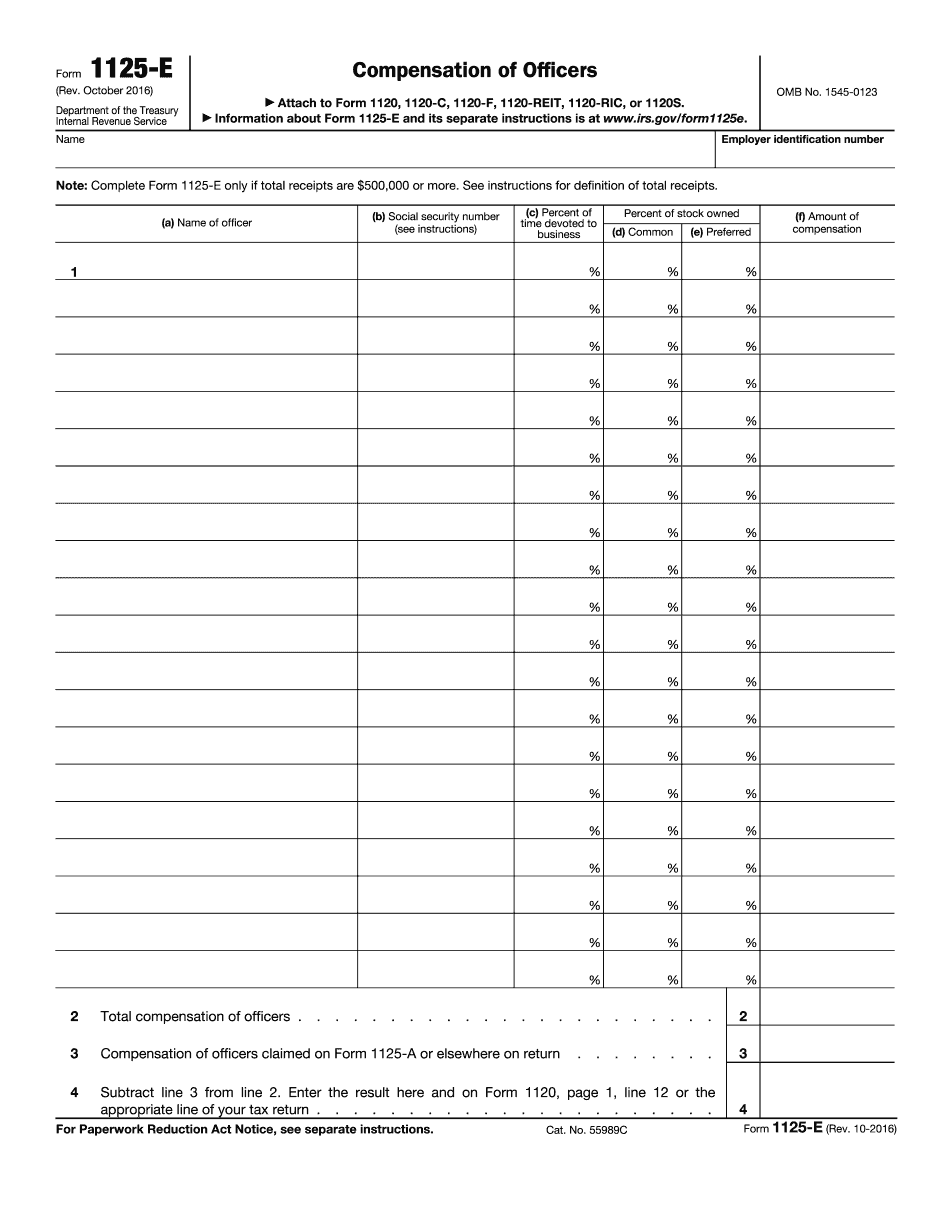

Form 1125-E online Gainesville Florida: What You Should Know

Form 3921 — IRS You must file Form 3921 The IRS says you should file Form 3921 with companies if you want to receive the research and development credit for expenses you pay for research and development activities related to certain qualifying intellectual property. The research and development tax credit may not be claimed if the costs for which you are claiming an offsetting tax benefit would be more than 500. Form 3921 & Qualifying Expenses The IRS requires tax filers to include in your gross income any qualifying research and development expenses for any activity you engage in that uses qualifying IP of which at least 500 of eligible expenses must be deducted. In addition, you must have any amount deducted from your qualified research and development expenses. These expenses include Qualifying Research and Development Expenses So don't be a “bad tax guy” and claim that you had to do the work in order to claim the credit. In fact, there is a big break for those who file Form 3921 and who qualify for a research and development credit. According to IRS, this credit is only available for a Qualifying Intellectual Property of an active project (not a series of related transactions) The following A qualifying IP can include new products that result from the research activities. In a case like Apple's iPhone, the qualifying IP would either be products that are introduced into the market and have a sale price less than 600 or the new technology that makes it possible for Apple to offer new products at a much lower cost and volume than previously (see Apple, Inc. v. Tax Court of Nevada, 976 F.2d 704 (9th Cir. 1992)). Qualifying IP can also be any of the following factors • New, highly sought-after new technology, or • New, highly sought-after methods of using existing technology, or • New materials (new in or new to the field of scientific or other research), or • New products (new or improved in any material aspect). Qualifying Qualifying IP would always have to result from your research The IRS doesn't say you can deduct all or even any part of the qualifying expenses. To take advantage of this credit, you would also have to file Form 902 (or maybe Q906).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E online Gainesville Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1125-E online Gainesville Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E online Gainesville Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E online Gainesville Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.