Award-winning PDF software

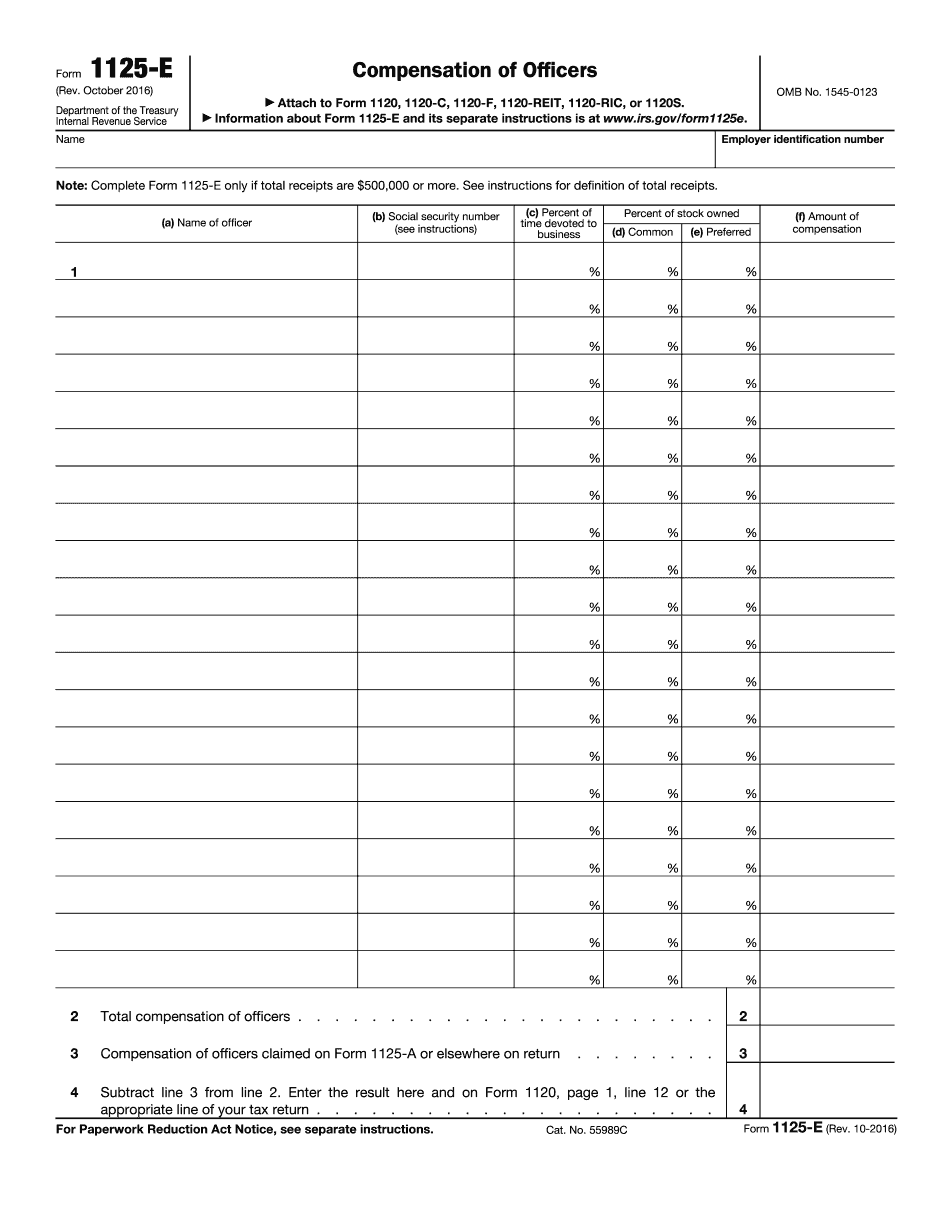

Form 1125-E Salt Lake City Utah: What You Should Know

The Form 1125-E instructions state, “Form 1125-E can be used to report compensation of officers for tax years beginning after 2017, and if the corporation has total receipts of 500,000 or more.” Why is this form required, when Form 8853 is used to report the compensation of those officers who are not on corporate time? I'm not sure. What counts as “paid on behalf of”? What has to be reported? The compensation must be paid for services rendered, the officer must provide a completed Form 1125-E, “Compensation of Officers,” and a statement attesting to his or her status as an officer. The following are examples of the types of statements required for Form 1125-E: the individual's name, address and date of birth; the individual's Social Security Number or other taxpayer identification number, if needed; the individual's position on the corporation's board of directors or other committees and the dates of any such positions; whether the individual is compensated by salary, contract, commission, bonus, or otherwise and the amount of such compensation; whether the individual is a director or officer of the corporation and the date on which he or she became a director or officer; whether the individual is a former director or officer of the corporation and the date on which he or she retired; and whether the officer has made any payments, or made any gifts, either in connection with the officer's employment, or after the officer's employment, to a person or entity with which the officer was not personally associated. Additionally, the following statements must be included if the officer was paid under an option: the individual's name and date of vesting in the option; whether the employee had rights or options with respect to the value of the employee's compensation; the individual's name, address and Social Security number and whether an employee identification number has been assigned; and the individual's name, address, and Social Security number. Who must report compensation on the form? Payments to individuals that are not on payroll for the corporation must be reported on Form 1125-E, “Compensation of Officers.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1125-E Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.