Award-winning PDF software

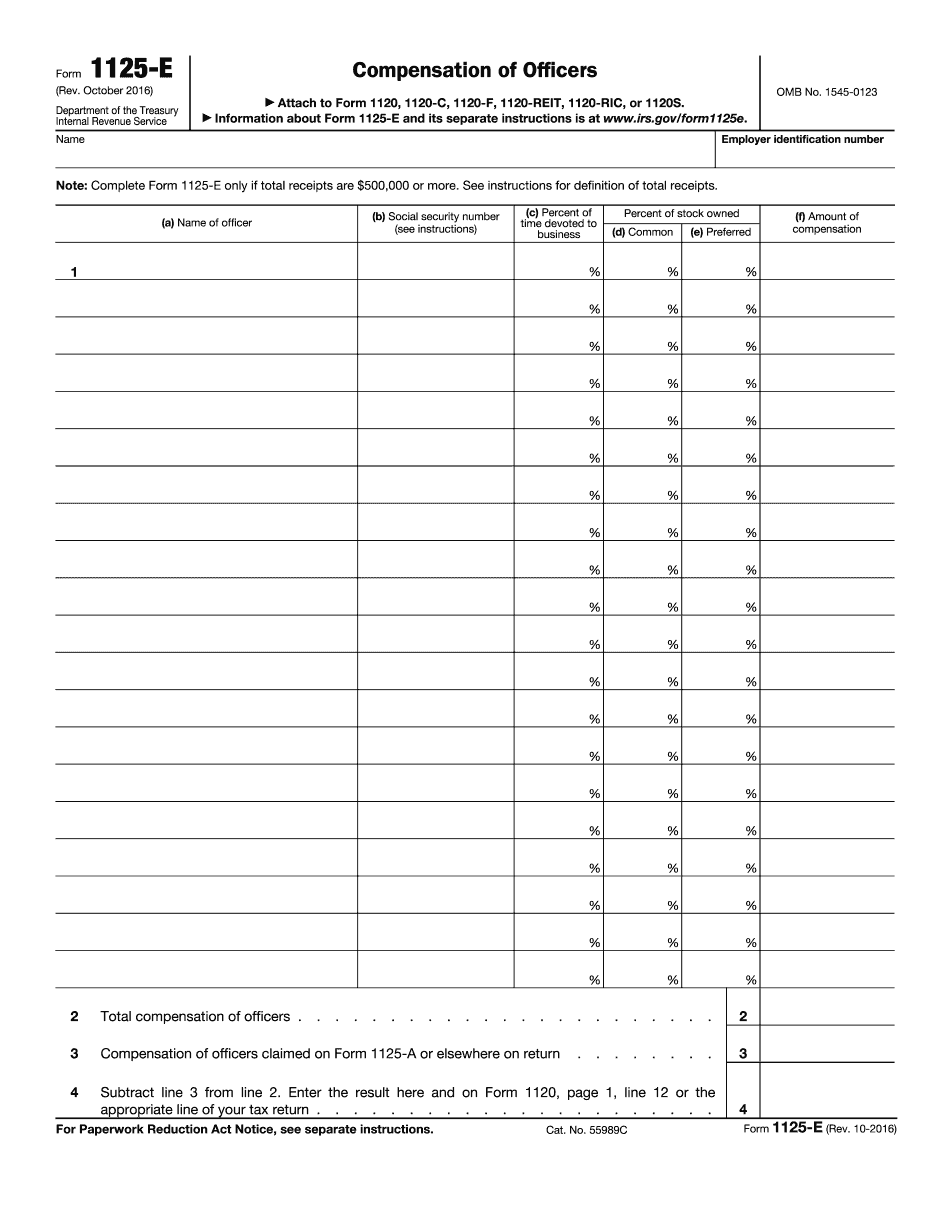

Form 1125-E for New Jersey: What You Should Know

You can find them here. Oct 5, 2025 — Form 8958 will be available with a new look and improved design. Please refer to the Instruction Sheet 2. Mar 16, 2025 — The Division of Taxation is now accepting applications to obtain tax-exempt bonds, which are taxed at the tax rate. You can find them here. State of Rhode Island. Division of Taxation. RI.gov Sep 1, 2025 — Forms 3944-A, 3944B, and 3944C will be available for filing. Aug 5, 2025 — The RI Division of Taxation has launched the Electronic Federal Proforma Application for Tax-Exempt Bonds for all state and local governments. You can find them at RI.gov and on this website. Aug 5, 2025 — The RI Division of Taxation is providing a tool for filing the 1098-E information return. You can find them here. Aug 3, 2025 — The RI Department of Revenue is now accepting applications for the Federal Tax Credit for Renewable Energy Costs on solar systems and wind turbines. If you are not sure how to report these or have any technical questions, please visit the RI Department of Revenue website. New Form 3950 — RI State Government — RI.gov Aug 2, 2025 — The RI Division of Taxation has released a new form — Form 3950. The state-only form is not tax-collecting. It is for use only in State. Sep 1, 2025 — Beginning September 1, 2018, you cannot buy or sell shares of the same company unless the two transactions occur on August 15, 2018. The RI Division of Taxation has issued “New Buy and Sell Notice.” Sep 1, 2018—The Division of Taxation has launched the “Mid” service to help taxpayers locate and pay for their state ID card. Sep 12, 2025 — There will not be sales tax on supplies, such as paper and ink, purchased by small-businesses on September 23, 2018. Sep 12, 2025 — The Division of Taxation has launched the “Mid” service to help taxpayers locate and pay for their state ID card. Sep 11, 2018— The RI Division of Taxation has released the second part of the Form 6797B to replace the old 6797A Form 6797. This new form is not tax-collecting.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1125-E for New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1125-E for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1125-E for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1125-E for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.